Profitable Decarbonization: A Clear Path to Winning CFO Buy-In (Part 1)

The Problem with “Emission Abatement Only”

Let’s be honest: CFOs, boards, and P&L owners are measured on margins, cash, and returns. If a decarbonization strategy doesn’t deliver profitable outcomes, it won’t survive the budget review. In 2025, decarbonization isn’t just compliance—it’s a strategic lever for cost, risk, and growth.

For too long, corporate sustainability has been pitched as a moral imperative or regulatory checkbox. That era is nearing an end. In 2025, decarbonization is a business strategy, not a compliance exercise — and profitability is the key to unlocking lasting climate action.

In Part 1 of our Profitable Decarbonization series, we'll show how to make all emissions scopes—1, 2 and 3—deliver measurable returns: lower OPEX, smarter capex timing, and reduced transition risk.

Profitability > Policy: How CFOs Green‑light Climate Investments

Regulation still matters, but this year we saw loosening timelines and capital flowing to projects with a clear business case. Even where CAPEX is required, OPEX savings can be substantial—and faster to realize—when you prioritize energy efficiency, asset upgrades, and procurement shifts.

Fresh evidence from McKinsey and BCG back the pivot to returns:

- 82% of companies report economic benefits from decarbonization; 6% say those benefits exceed 10% of annual revenue

- Leading firms cut up to 40% of emissions while achieving ~15% financial gains

- Top decarbonizers generate more than 7% of annual revenue through sustainability-linked initiatives

Verdantix likewise finds sustainability teams under pressure to tie plans to financial outcomes and integrate internal/external carbon pricing into business cases—precisely where software must help.

Bottom line: Decarbonization is not a cost center; with the right plan, it’s a profit driver that reduces risk and moves the needle on measurable impact.

How SINAI Makes Decarbonization Profitable

Two focus areas unlock ROI fastest: operations and supply chain. This dual focus lowers OPEX, reduces transition risk, and strengthens supplier relationships—while shrinking your footprint.

1. Business Operations (Scope 1 & 2 Calculations and Reductions)

- Forecast facility/equipment-level emissions and link them to financial metrics (NPV, IRR, payback) to size ROI

- Run scenario modeling and pathway charts to understand project sequencing and de-risk decisions

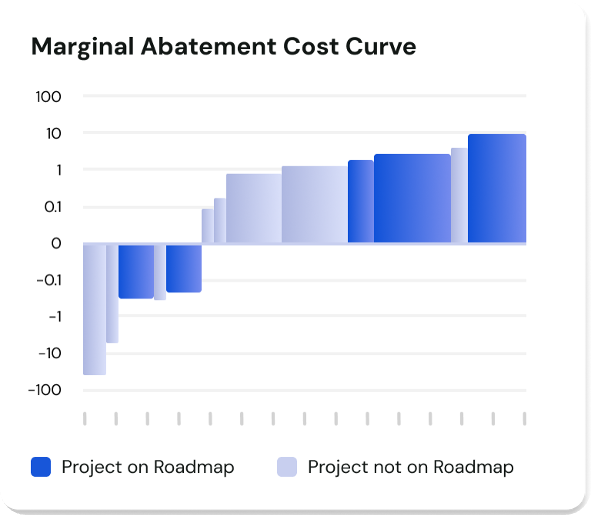

- Visualize abatement vs. cost with interactive MACC curves and generate investor- and board-ready transition plans

- Prioritize highest-impact, lowest-cost projects and drive OPEX savings in energy and maintenance

Explore SINAI’s precision tools for granular, finance-linked emissions management →

2. Supply Chain (Scope 3)

- Rank suppliers by emissions and spend to focus engagement where it matters.

- Benchmark suppliers to create procurement advantage (emissions + price) and negotiate toward lower-carbon inputs.

- Collect supplier data without survey fatigue via AI-assisted mapping and a no-code portal; track targets and embed into long-term roadmaps.

This dual focus lowers OPEX, reduces transition risk, and strengthens supplier relationships—while shrinking your footprint.

Explore SINAI’s Supplier Hub for a live view of supplier contributions →

Profitable Decarbonization, By Scope

- Scope 1 (direct operations): Prioritize efficiency and electrification at asset replacement milestones—e.g., switch end‑of‑life HVAC to heat pumps (often 3–5× more energy‑efficient than gas boilers) and add VSDs on fans/pumps (typical 20–30% energy savings in motor systems). Sequence projects by IRR and payback, not just abatement.

- Scope 2 (purchased energy): Contract for lower‑carbon electricity while modeling exposure to market and policy scenarios (e.g., ETS2 launches in 2027, with a potential one‑year delay if prices spike). Tie PPAs and efficiency to EBITDA‑per‑MWh.

- Scope 3 (value chain): Start where the money and tonnes are—top suppliers. Rank by emissions × spend, collect specific data, co‑design abatement roadmaps, and embed carbon shadow pricing in sourcing. For many sectors, Scope 3 is the majority of the footprint (often >70%), so procurement is a profit lever, not a reporting chore.

To win finance and the board, prioritize measures at the nexus of cost and carbon—initiatives that reduce emissions and enhance financial performance. Your platform should connect activity data, emission factors, and financials in one system so teams can evaluate, rank, and fund the most attractive projects.

SINAI’s MACC visualizations make this crystal clear by plotting the cost-effectiveness of different measures to reduce pollution and the potential emissions reduction (width of bars) against the marginal cost per unit of reduction.

How to read a marginal abatement cost curve (MACC):

- Bar width = potential emissions abatement (tCO₂e)

- Bar height = marginal cost (or savings) per tCO₂e

- Y-axis position (below zero) = ROI positive (cost-saving) projects

Examples of decarbonization projects may include replacing aging equipment or implementing energy efficiency initiatives, which can reduce OPEX, and lowering climate risk exposure — investments that pay off for both planet and profit.

SINAI’s Roadmap to Profitable Decarbonization

We see the most durable results when companies pursue a simple, universal lifecycle:

1. Measure – Calculate Scope 1, 2, and 3 GHG emissions (plus water/waste) with AI-assisted ingestion and 50,000+ emission factors to accelerate accuracy and hotspot detection.

2. Engage – Maximize Scope 3 coverage with AI-powered supplier data collection and enrichment (survey, LCA, datasets), designed to avoid survey fatigue. Suppliers can represent as much as 80% of your carbon footprint and finding your biggest climate offenders can be a significant lever towards lower costs.

3. Reduce – Model scenarios with advanced financials (NPV, IRR, payback), apply shadow/internal carbon pricing, and prioritize via MACC to fund the most profitable, high-impact initiatives first. Tie each measure to capital planning so operations can pick high‑IRR upgrades at natural replacement moments—no extra complexity or consulting required.

This journey ensures companies not only stay compliant with ESG regulations but also maximize ROI along the way.

Independent Validation for SINAI

Verdantix’s Smart Innovators: Carbon Management Software (Aug 2025) highlights SINAI’s strengths in flexible shadow pricing, scenario modeling, MACC, and climate‑informed capital allocation.

Analysts agree profitable decarbonization is the future , and SINAI is leading the way.

Read Verdantix's analysis here →

Profitable Decarbonization Case Snapshot: Wilson Sons

Wilson Sons, a maritime logistics operator, unified emissions data across fleets and port operations with SINAI—modeled 600 mitigation projects, built a consolidated MACC, and created a single source of truth.

- Model 600 mitigation projects

- Built a comprehensive MACC

- Created a single source of truth across segments

Outcome: a single source of truth across segments, 600+ modeled projects, an enterprise MACC, and CFO/board alignment to fund the highest‑IRR, lowest‑cost abatement first.

Your Call to Action

Stop pitching sustainability as a moral obligation. Start pitching profitability—returns, resilience, and real emissions cuts.

A profitable decarbonization focus is the best way to win finance teams, secure board approval, and achieve lasting climate and business impact.

Ready to fund the best projects first? See how SINAI ties tonnes to EBITDA across Scopes 1–3 with audit‑grade data, MACC, and internal carbon pricing. Book a demo →

FAQs on Profitable Decarbonization

1. How do we prove ROI on decarbonization projects?

Use MACC with integrated financials (IRR, NPV, payback) and shadow pricing to rank projects; report wins quarterly for CFO and board.

2. What if most of our footprint is Scope 3?

Start with top suppliers by emissions × spend, collect specific data, and co‑fund practical switches (materials, logistics, energy). For many sectors, Scope 3 is the majority of emissions; concentrating effort here creates outsized returns.

3. How does SINAI align with regulations while staying audit-ready?

Automated outputs and evidence trails mapped to ISSB/GRI/CSRD/CBAM/CDP, plus scenario-based transition plans for finance and the board.

-3.png)

-2.png)